Dividend Calculator

Easy to use dividend calculator. Estimate the dividend and growth yield of your investment with a few clicks.

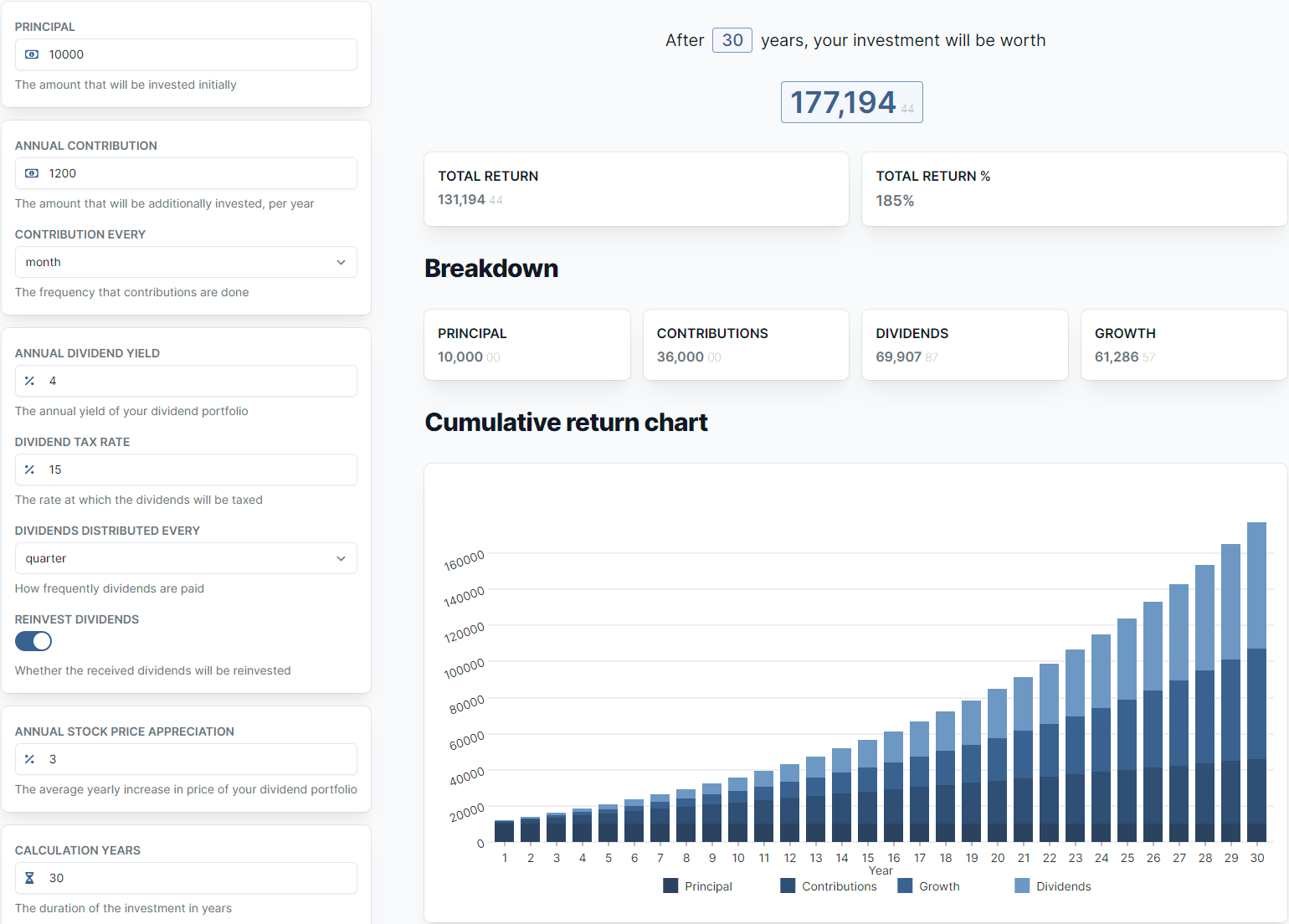

Accurate estimations

Estimate your dividend income

Estimate how much income you might receive from your investments over a given period.

- Customizable Parameters.

- Adjust parameters to reflect changes in your investment portfolios or market conditions.

- Calculation and Results.

- Upon entering the necessary data, the app performs calculations to determine the projected dividend payments.

- Graphical Representation.

- Visual representations, such as graphs or charts, that help you better understand how your dividend income may change over time.